Insurance and Storm Damage

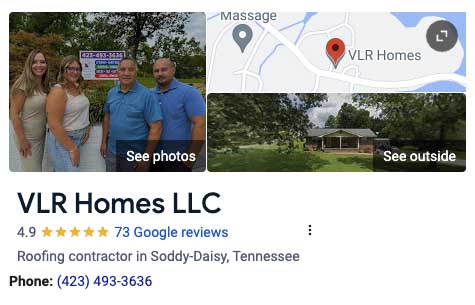

You’ve found Tennessee’s top rated roofing contractor! We don’t leave the job until you’re 100% satisfied!

The Basics of Insurance and Storm Damage

Get the Best Help Filing Your Storm Damage Insurance Claim

Your roof and the rest of your property can suffer from various damages due to storms and bad weather. There are many layers to your roofing to keep your home or business protected, starting with the materials. If any of these get damaged or go missing, it can expose the underlayment and decking to leaks or water damage.

When your property’s afflicted by storm damage, you should file an insurance claim as soon as possible. Between the claim process being a lot more involved than people realize and having to choose a contractor eventually anyway, you should give VLR Homes, LLC a call today! Our experts will help you throughout the process and deliver quality results for your storm damage repair!

How to Document Your Storm Damages

Knowing what to do when you suspect roofing issues after a storm or when you notice water damage is crucial. The first step is to document the damages to your roof. Some storm damages are bad enough for a roof replacement but, without proper documentation and photographs, the insurance company could find a way to avoid paying.

In fact, the insurance company may attempt to shift the blame for damages to something else, like cosmetic wear that added up. That’s why it’s important to call us as soon as possible after a storm to maximize your claim for roof repair or replacement. Our experts can guide you on what to document and take pictures of to support your claim.

Before your insurance company sends their adjuster for damage assessment, it’s important to take numerous pictures of the storm damages. Whether it’s a simple roof repair or a full roof replacement, documenting everything can help you secure at least partial coverage. Keep all of your documentation handy to give a copy to the adjuster when they show up.

Call Your Insurance Carrier

Once you’ve documented the damage to your roof, it’s important to contact your insurance provider immediately. A claim could become invalid if you wait too long after a storm. Delaying your claim could also send the message that the damages are not a priority. To ensure that you receive the coverage you deserve, report your storm damage as soon as possible.

Choose VLR Homes, LLC as Your Contractor

It’s recommended to start researching roofing contractors after filing your insurance claim. We can save you the trouble and say that VLR Homes, LLC offers the best roof repair and replacement services. We also have extensive experience with all types of residential and commercial roofing. We advise you to call our trained experts as soon as possible.

We’ll conduct a thorough inspection of your roof and the rest of your property for signs of water damage. Your underlayment and decking can be exposed or heavily damaged if any materials are pulled off or cracked by a storm. Leaks and water damage can extend to your walls, ceilings, and foundation, which is why a full inspection is necessary.

Roof, wind, and water damage are some typical ways that a storm can affect your home or business. The good news is that restoration services for your roof are considered separate from your insurance company’s designated contractor. You have the freedom to choose the contractor that performs your roof repair or replacement.

Some insurance policies may contain clauses requiring you to use a “managed repair program” for any covered property damage. We strongly urge your home or business to avoid such policies, as they limit your choices and may not provide the best repair services. It’s crucial to choose a contractor you trust, which is why you should call VLR Homes, LLC today!

What to Do After Your Return

Assuming that you’ve received reimbursement from your claim, which can take months, you’ll have options for your damaged roof. While some homeowners attempt to do their own repairs, this can be risky and end up costing more in the long run. That’s why it’s best to work with experienced professionals like VLR Homes, LLC after a storm.

Our team has experience with anything from storm damage repair to roof replacement. We know exactly what to look for and how to address issues throughout your property. We’ll inspect your roof and note any storm damage. That way, we can recommend the best service and material for your protection.

Working with VLR Homes, LLC has many benefits, including our knowledge of roofing. Our ability to spot issues beyond just your roof and our commitment to fast and reliable service are things you can expect. We’ll work quickly to take care of your roof before the next storm hits, so give us a call as soon as possible!

Need a Claim Reversal?

Storm damage can lead to significant expenses depending on the level of damage. Even if you file a successful claim, it doesn’t mean that you’ll get full coverage for your roof repair. Insurance companies may try to minimize their liability by providing only partial reimbursement, citing reasons such as “cosmetic damages” or other pre-existing conditions.

That’s why it’s essential to keep a record of any previous roof maintenance or repairs and document the storm damage. In case of partial coverage, you can consider a claims reversal. We’ll help you get the best adjuster advice to improve your chances of a successful follow-up claim when you call us today!

Tips for a Successful Insurance Claim

When you need roof repair or replacement, you’ve come to the right place. VLR Homes, LLC has a lot of experience with roofing services. That extends to the process of filing for an insurance claim. You can trust our team to help you have the best chance of success, starting with following these 6 pieces of advice:

Keep track of all damages and roofing services. Any roof repair or maintenance you’ve had done by a professional should be documented and saved. Make sure you have a receipt as evidence of the service. If there’s storm damage to your property, take pictures of anything you think was damaged or was the cause of said damage.

When your insurance company sends their adjuster, they’ll check numerous things for auto and property damage. All of your documentation should be dated and valued for simplicity. That way, you can bring a copy for the adjuster to look over.

Contact your insurance carrier sooner than later. A storm can do a lot of damage to your residential or commercial property, but there’s a time limit on filing a claim. Insurance companies don’t generally accept a claim after enough time has passed, so you should report damages as soon as possible.

Have your policy number ready when you reach out and make sure they have a point of contact on your end, be it an email or phone number. The worse the storm damage, the quicker your claim will be processed. It can take months for some insurance claims to go through, so be sure to let them know if your family has any special needs to help expedite things.

You might also want to find out an estimated time when the adjuster will contact you so that you’re ready. It’s a good idea to have their supervisor’s number in case they have difficulty getting a hold of you. For any flood insurance claim, you’ll have to contact that carrier specifically.

Make sure you use text alerts. Most insurance providers use SMS or text notifications now for claim updates. You can learn the status, estimated reimbursement, and date that it will be sent via text alert. You should get one when your claim is filed in the first place to know that your alerts are working.

Unless your insurance provider says to, save everything. If a storm damage your property, make sure you don’t discard or throw away anything until the insurance carrier is done with it. They way, you retain any evidence of the storm damage. If your local laws require you to get rid of something, document and photograph it first.

Keep a claim diary. One of the best methods of organization for your insurance claim is to write everything down in a journal. Pictures are a great option, but you should also keep track of everyone you interact with regarding your claim in a diary. Write down their name, title, and contact information for future knowledge.

Other details to record are the date of your conversation, what you talked about, and the exact time and date. The difference between a successful claim and one that isn’t can come down to a matter of details. Plus, you’ll keep all of your information organized in one place.

Know your local emergency services. Roof repair and replacement are our business and we excel at the services. However, storm damages can leave your home or business in a state of crisis. Emergency services can patch up windows, board up doors, and extract water from your property.

It’s also important to have your roof covered before another storm rolls through. While we’ll work fast when you call us, emergency personnel can cover your roofing with a tarp or other material in the meantime to prevent further damages. If storm damage creates an unlivable space, your insurance company might provide a check for your living arrangements.

To make sure that you get the most out of your insurance claim, you can trust VLR Homes, LLC. Our team of professionals will work hard to give you the best chance of a successful claim and offer quality services for your protection. Give us a call as soon as possible once a storm has damaged your home or commercial property to get started!

Service Areas

- HQ: Soddy-Daisy, TN

- Bakewell, TN

- Dayton, TN

- Graysville, TN

- Harrison, TN

- Hixson, TN

- Lupton City, TN

- Ooltewah, TN

- Red Bank, TN

- Sale Creek, TN

- Signal Mountain, TN

- Walden, TN

About VLR Homes, LLC

Founded in 2019 by Francisco Romero, VLR Homes is dedicated to providing the area with roofing and remodeling services of the highest standard. Find out how this family-owned and operated company can put over a decade of general contracting experience to work for you!

VLR Homes, LLC

4.7

We have engaged Francisco and VLR Homes 3 times now. From painting the house, remodeling a master bath and constructing a screened in porch area they have responded with quality work at a fair price. When things came up like they always do, VLR had a solution (some panels of 50 year old siding replaced with Tyvek and up to code replacement). Again, at a fair price and done right the first time. Francisco is responsive with the good and the bad news straight up and always with a plan. We intend to use VLR in the future for projects large or small.

-Paul N. in Hixson, TN

Looking for the best gutter repair Chattanooga, TN can offer? Call us today!